From remote working, to digital payments, to automated savings apps and automated financial advice, how we earn, spend, save and invest money is changing. We asked people to tell us how they think money will be different five years from now.

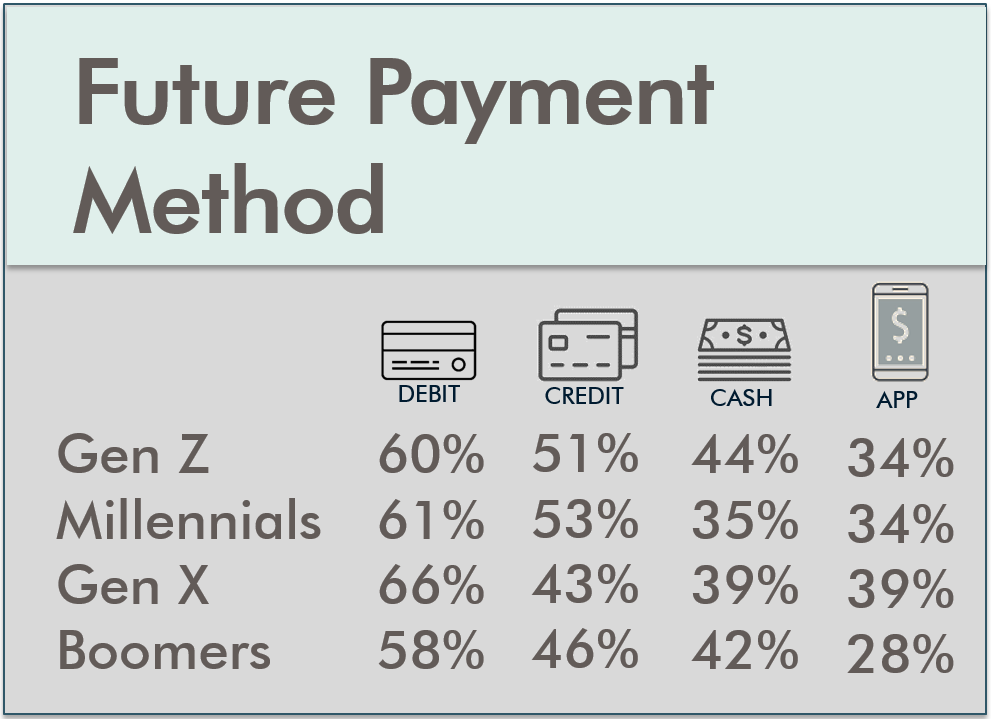

What did we find? Among the U.S. general population, debit is in first place. It remains the highest ranked for future payment methods. 60% of people ranked it as one of the top two payment methods they will use in the next five years. While credit is still in a close second place, cash and digital apps are running neck and neck, suggesting traditional payment methods may be edged out as digital alternatives become more mainstream.

When we break the results down by generation, the story gets pretty interesting. The 16 to 18 year old Gen Zers in our study are still using more traditional methods. They rank debit as the most common future payment method closely followed by credit and cash. Our hypothesis is that these young adults are still new to money and digital apps will increase over time. How this generation makes, spends, saves, and invests money will certainly be critical in the years to come.

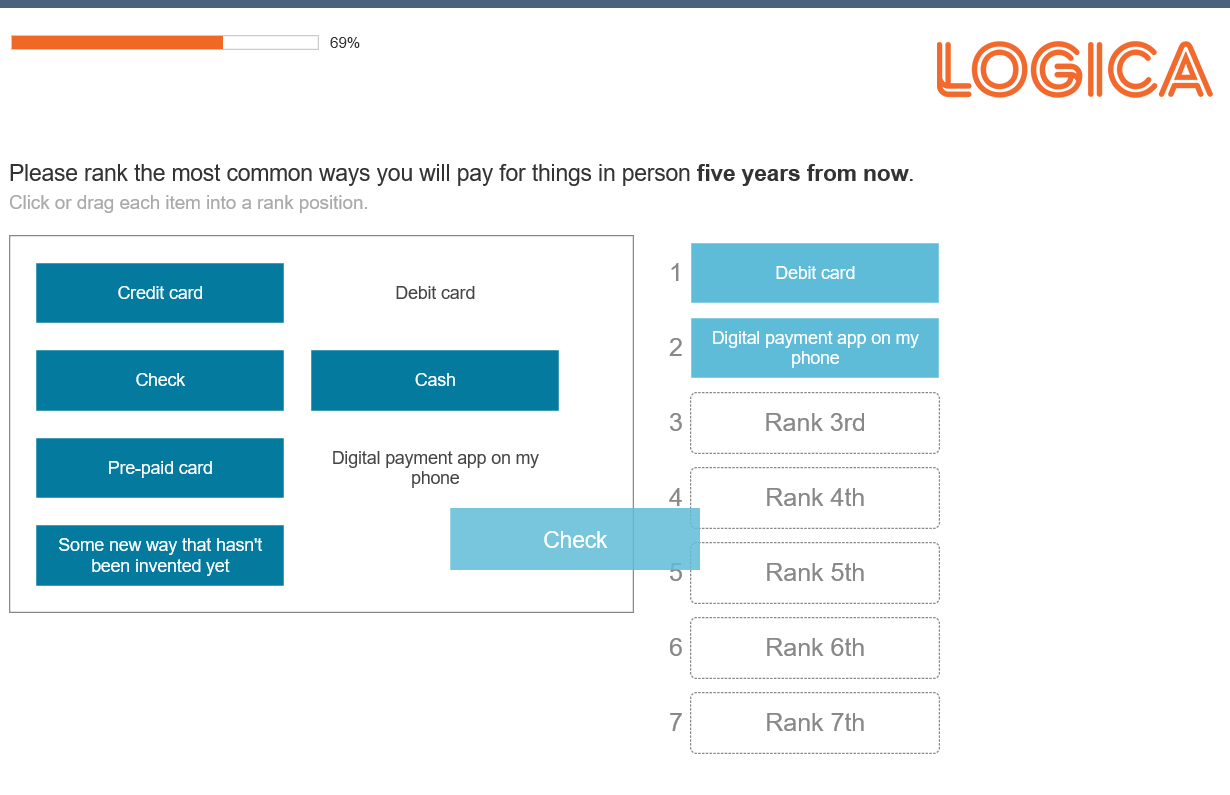

Given the futuristic nature of our questions and the inclusion of the younger generation, Gen Z, we tested a more modern research design. For this we teamed up with CatalystMR to program the survey with a traditional drop down ranking question and a more gamified drag and drop question.

We found the results to be comparable for both techniques, with no significant differences. This puts our minds at ease as we construct survey questions for today’s survey taker and device. Optimizing surveys for a more modern execution is a natural step for us.

If you’d like to take a step in the future to engage, contact us engage@logicaresearch.com